Abstract

The purpose of this study is the elaboration of the cointegration implication at currency exchange rates from Bangladesh and India regarding the Covid-19 pandemic. For this investigation, the exchange rate data were employed every day from March 2018 to March 2022. The Engle-Granger’s Two-Step Cointegration Test and the Johansen Test were also used to determine the co-move in exchange rate. On the basis of the study’s findings, a long-term relationship was indicated in terms of the exchange rates between Bangladesh and India that concerned even more with time.

The conclusion also corresponds with the conducted test, both Engle-Granger Test and Johansen Test for the cointegration. Furthermore, the results of the research allowed concluding that applications containing persisting alternation in the exchange rates accompany the co-move pattern of a cointegration and changes to it that were a part of the Covid-19 shock. This research finds that to prevent short-term dislocations from turning into a long-term trend, it is very crucial to swiftly take actions.

Contents

Chapter 1: Introduction

1.1 Background of the Study

1.2 Research Problem

1.3 Objectives of the Study

1.4 Research Questions

1.5 Significance of the Study

1.6 Scope and Limitations

Chapter 2: Literature Review

2.1 Introduction

2.2 Covid-19 on Exchange Rates Theories

2.3 Empirical Studies on Exchange Rate Cointegration

2.4 Impact of Covid-19 on Exchange Rates

Chapter 3: Data and Methodology

3.1 Introduction

3.2.1 Data Sources

3.3 Methodology

3.4 Data Description

3.5 Descriptive Statistics

Chapter 4: Discussion

4.1 Introduction

4.2 Interpretation of the Results

4.3 Comparison with the Past Studies

4.4.3 Policy Implications

4.5 Limitations of the Study

4.6 Suggestions for Future Research

Chapter 5: Conclusion

5.1 Introduction

5.2 Summary of Findings

5.3 Final Remarks

References

Chapter 1: Introduction

1.1 Background of the Study

The Covid-19 pandemic has introduced numerous challenges to the current state of the global economy (Jamal and Bhat, 2022). Because of the conditions brought by the pandemic, pronounced global ramifications were centred on international trades, financial markets, and exchange rates, all of which have been escalated by the pandemic’s performance alterations within and among countries. There have been numerous economic struggles as a result of the Covid-19 pandemic in both India and Bangladesh, with the two countries both located in South Asia. Furthermore, the countries are neighbouring, with India being the most significant contributor in terms of trade to Bangladesh (Qamruzzaman, KARIM and JAHAN, 2021). However, considering that many major economies have faced concomitant economic struggles, the exchange rate behaviour of both these vital South Asian economies also becomes crucial.

International finance is inseparable from exchange rates because they are central to trade balances, the inflow and outflow of investments, and the state of the economy at large. Evidently, in the past, Indian, and Bangladeshi exchange rates were linked to some capacity, as often is the case with neighbouring countries (Khan et al., 2021). Central to that were their close trade relations and exchange agreements, as well as the similar structure of the economy in both countries. However, considering the unique circumstances of the Covid-19 pandemic, it becomes essential to analyse to what extent these exchange rates are cointegrated or if they are cointegrated at all.

Cointegration analysis is applied to analyse such factors as exchange rates to determine the extent to which two separate currencies are related in the long term. If two such exchange rates are cointegrated, that would mean that they remain linked and move together over time, regardless of short-term differences (Li et al., 2022). This information can prove extremely useful for policymakers and economists as it provides a great insight into the degree or kind of such linking and the possibilities in the event of the presence of external shocks.

1.2 Research Problem

The main research question is the following: during the period of the Covid-19 crisis, were the exchange rates of India and Bangladesh cointegrated? The reasons are the following: it can be considered whether, through different crises, an analysis of the degree of stability of two countries involved in the pandemic can be conducted using exchange rate regimes that do not vary significantly from the value and related interventions and policies. The information can be used by both investors and policy makers. Investors may benefit from long-term exchange rate moves and relationships between the two counties, leading to better investment decisions and an improvement in the evaluation of the economies of the countries involved in trade.

1.3 Objectives of the Study

The aim of the research is to investigate the cointegration of the Indian and Bangladeshi exchange rates in the period of the Covid-19 epidemic. Its objectives include:

1. To analyse the long-term equilibrium relationship between the exchange rates of India and Bangladesh during the Covid-19 pandemic, using econometric methods. This requirement is to determine whether there exists some long term relationship between the exchange rates of both said country.

2. To investigate the short-run dynamics and adjustment towards equilibrium, this requirement is to evaluate how short-run deviations from the long run equilibrium stabilize and correct themselves over time

3. To derive policy recommendations based on the findings: This objective seeks to help lawmakers in both countries ensure adequate management of stability of their economies. This should ease response to any global crisis next time.

1.4 Research Questions

The research questions addressed in the study to realize the goals set:

- What are the exchange rates of India and Bangladesh are cointegrated during the Covid-19 pandemic period?

- Are short-term dynamics and adjustments toward the long-term equilibrium relationship between the exchange rates?

- Does the Covid-19 pandemic affected the cointegration and dynamics of the exchange rates?

1.5 Significance of the Study

The first reason is that the research is potentially useful for policymakers, economists, investors, and academicians. This dimension is related to the fact that existing findings on such aspects as exchange rate dynamics and cointegration could be viewed in terms of the existing literature. The study could highlight the issue from the perspective of a global crisis as a pandemic. Therefore, this study is significant for the following reasons:

In the context of global economic crises, it can help to schedule actions of countries and associations, such as the EU.

The study details the dependence of India and Bangladesh on each other in terms of the given research. Therefore, the significance is extended to the understanding of countries and regions’ economic reliance.

It provides investors and traders with information that could optimize their decisions on which currency to invest in and what to hedge.

1.6 Scope and Limitations

This research holds the enormous utility potential to several groups- the stakeholders making various regulations: policymakers, economists, investors, and academicians. This study’s findings contribute to the relevant literature on the dynamics, influence, and cointegration of exchange rates. It is especially relevant when discussing the aspects of global economic crises. More specifically, the significance of this study is as follows:

Policy Implications: understanding of the cointegration of exchange rates can assist policymakers in their decision-making, such as economic policies prerequisite for enhancing economic stability, and response to negative external shocks;

Economic Insights: The study’s findings offer valuables insights related to the economic interdependence between India and Bangladesh, as well as more broad economic interdependence of two bordering countries;

Investment Strategies: investors, and especially financial analysts, may use these findings for making the informed currency investments or appropriate hedging strategies;

Academic Contribution: this study is likely to contribute to the academic debate of exchange rate cointegration and scope and utility of global crises. It is likely to act as an example for the future cointegration studies, as well as comparative studies in this specific area.

Chapter 2: Literature Review

2.1 Introduction

The chapter presents the literature review on the cointegration of exchange rates. First, the theoretical background is given since it is necessary for a proper understanding of the dynamics of exchange rates and cointegration. Second, it is observed how other researchers have analyzed exchange rate cointegration based on their empirical studies. Furthermore, this research attempted to analyse the problem of the pandemic and its impact on exchange rates with reference to India and Bangladesh. As a result, research gaps have been identified, and the current study tries to fill them.

2.2 Covid-19 on Exchange Rates Theories

The theoretical origin of contagion comes from the currency crisis. The three-generation model was developed by Krugman’s first generation model in 1979 posits that the country adopts a fixed exchange rate regime (Hülsewig and Steinbach, 2021). However, the country’s fundamentals, such as high fiscal deficit, are severe, and the domestic policy does not change the upward slope of the deficit. Hence, the domestic policy is monetised with the funding of expansionary policy is more than warranted. The country’s speculative attack is due to this reason. Second generation model illustrates that even with incredibly strong fundamentals of a country there are still external asymmetric shocks such as psychology, including self-fulfilling prophecy, herding and information (Bianchi, Faccini and Melosi, 2020). Asymmetry and the country’s differences are not seen.

Several countries in the same region that investors would cause investors in the same country as mainly homogeneous. Currency imbalance and maturity imbalance were pointed out by the third generation model of financial liberalisation and the over-leverage syndrome (Banik, 2023). In addition, Maroney et al. also argue that imbalances can lead to a currency crisis in a particular country. Subsequently, the theoretical conception of pure contagion, primarily related to market psychology, was researched by (Arya and Singh, 2022)

The salient causes of contagion preventions may be a common shock (Mishra and Mishra, 2022), interconnected interrelations in the international context of trade, a competitive devaluation (Corsetti et al., 2000), and the close interlinking in the financial domain (Banik, 2023). Various typologies of contagion had been classified by different taxing, where the similar events may be taxonomically disparate by various characteristics, such as taxonomy procedure, the definite point of time of happening the crisis, affected countries, and another taxonomical causes. The study performed by Chowdhury et al., (2024) investigated the nonexistence of significance of trade contagion in the case of the Asian Financial Crisis in 1997-1998 and the Mexico crisis in 1994. Conversely, in the case when an interaction term is added between the trade and current account gap, the coefficient of trade shows a significance with a probability of 0.05. Meanwhile, the study by Haldane, (2018) states the fact of the trade channel of Asia’s affected countries in a similar crisis as being the level of export competitiveness with a third country. A study by Pandey, Sergeeva and Gudla, (2021) examined the phenomenon of regression of the markets of Bangladesh and India. The result of the study was to reveal a fact that the US market regression influences the market in Bangladesh. At the same time, the data does not show any fact of a reaction to the regression of the Indian market with the influence on the regression of the Bangladeshi stock market. In addition, Amin et al., (2021) in their study adduced additional evidence of the long-term relationship of the two countries’ exchange rates.

According to a different analysis, Aruga, Islam and Jannat, (2020) used the Engle-Granger two-step cointegration test and the Johansen cointegration test to investigate the equilibrium impact within the Bangladesh and India’s exchange rates system. The research on regional economic integration studied by Nawaz, (2021) has shown the merits and limitations to be encountered with the solid ties between neighboring countries. A series of studies have employed cointegration tests to investigate a long-term connectivity involving exchange rates. Examples include the study on exchange rate interdependence and contagion by Rahman, Murad and Wang, (2024). According to this study, “any transitory-outside-long-run-shock that does not disturb the long-run equilibrium is a pure contagion effect”. Based on Jain et al., (2021) results, it is observed that a pure contagion shock can only improve short-run but not long-run correlation. In addition, a shock that is based on a fundamental can enhance short-run and long-run correlation.

Sarker, (2024) conducted a study during the calamitous period by employing the Granger causality for the vast majority of the financial markets to find when and where financial contagion takes place between markets. Khatri, Kashif and Shaikh, (2017) decomposed the observed USD-EUR exchange rate into three separate components, such as a common factor and two idiosyncratic components. Furthermore, Saleem, (2022) applied the generalized autoregressive conditional heteroscedasticity model to analyze volatility spill-over that may exist between various currencies. Wavelet analysis was employed in the study by Ghauri et al., (2022) to research financial interdependence, time-varying period-graphic contagion, and financial contagion in the time and frequency fields.

Akter et al., (2022) used a spatial econometric approach, whereas Shaikh et al., (2021) used a decent panel probity model to determine the impact of the boarder variables, including the factors that might either spread currency contagion or make certain countries more exposed to contagion. Most of the empirical analysis showed that correlation estimate formed from some empirical analysis in the presence of heteroscedasticity generates bias in testing for the contagion effect. In the study by Bhat and Bhat, (2021), the authors find that the fact heteroscedasticity bias was present can be experienced because the impact of volatility is statistically the same and is not different across scales in which correlation is recorded. Journal articles and credibility are significant when studying the contagion effect. Sayeda, (2020) have studied the importance of shocks transmission; hence, these articles provide an essential empirical circulation of how to conduct and analyze exchange rate behavior during the crisis.

The Covid-19 pandemic led to an increased impact on global financial markets. More specifically, according to Ahmad and others, (2016), such effect is determined by increased volatility and disruptions resulting from the mentioned pandemic. It should be attributed to the situation regarding different types of assets. Thus, it is important to examine the effects of this global crisis on the currency exchange rates in general and the ones in Bangladesh and India in particular, especially because of the high integration of these countries and the global economy. In addition, the contributions made by Bhuvaneshwari and Ramya, (2017) regarding the importance of investor sentiment are very important. It is explained by the fact that it is important to know certain behavioural characteristics while assessing the transmission effects on currency exchange rates during the mentioned crisis.

On the one hand, the mentioned transmission effect is influenced by some challenges to the econometric methodologies mentioned by Audry, Ulfat and others, (2021). In detail, it is because of the mentioned latter reliance on normal time domain instrument. It makes the assessment of the effect on currency exchange contagion distinction extremely hard in the case of the mentioned pandemic because it is hard to specify whether contagion is driven by the fundamentals and exogenous shocks as the other factors that can be transmitted.

2.3 Empirical Studies on Exchange Rate Cointegration

A high number of empirical studies focus on evaluating the cointegration of exchange rates in different countries and periods. These studies examine the long-run relationships between currencies and the factors that affect them.

An earlier study of major international currencies such as the US Dollar, Euro, and Japanese Yen made the first attempt to identify cointegration among exchange rates (Ramdhany et al., 2018). While examining G7 currencies, Ramdhany et al., (2018) found that the long-run relationships were strong due to economic foundations Existing studies of these developed countries already confirm their cointegration.

More recent studies examine cointegration in emerging markets. For instance, Narayan examined Asian currencies and demonstrated significant long-run relationships explained by trade and the presence of financial institutions. Hassan, Wajid and Kalim, (2017) assessed exchange rates among Southeast Asian countries in 2005 and also confirmed their cointegration mentioning substantial trade volumes and economic cooperation.

A limited amount of research performs the analysis of India with neighboring Bangladesh in the exchange rate concept. While examining South Asian countries, (Kremens and Martin, 2019) point to the existing effect that was determined by the flows of remittances and the balance of trade. Currently, the research from an article by Lilley et al., (2022) proves that these findings are accurate, and exchange rates between such countries as India and Bangladesh cointegrate due to the presence of economic relationships

2.4 Impact of Covid-19 on Exchange Rates

Covid-19 is responsible for a significant influence on the global financing market and respective exchange rates. The pandemic and unanticipated economic repercussions from lockdowns and overall social distancing along with almost unprecedented state interventions stimulate exchange rate allocation and fluctuations.

In the context of the global impact, the pandemic caused the so-called flight to safety, which implies that investors preferred to invest in the US Dollar and other safe-haven currencies, resulting in massive depreciation of local currencies in emerging markets, as confirmed by the IMF (Engel, 2016). With regard to exchange rate dynamics in India, the country had also experienced high volatility, and the Indian Rupee had significantly depreciated during the first months of the pandemic. However, thanks to subsequent rate cuts and liquidity injections, the Reserve Bank of India managed to enhance the stability of the exchange rate. Related studies indicate that the exchange rate dynamics in India during the COVID-19 pandemic resulted from complex interactions between local and global risk sentiments, as highlighted (Khatri, Kashif and Shaikh, 2017). On the other hand, the Bangladeshi Taka also faced pressure, it was less severe compared to the challenges, which its Indian counterpart had to experience. However, the country was able to withstand the external shocks due to the strong inflow of remittances and a relatively stable export sector and benefited from the effective policy response, as confirmed by (Ramdhany et al., 2018). At the same time, the results of the study by Ramdhany et al., (2018), who researched the exchange rate responses to the COVID-19 pandemic in South Asian countries, including India and Bangladesh, proved that both India and Bangladesh and displayed different exchange rate response patterns, with various degrees of volatility and recovery recorded only a year after the beginning of the pandemic.

Chapter 3: Data and Methodology

3.1 Introduction

This chapter describes the data and methodologies used to examine the cointegration of exchange rates between India and Bangladesh during the Covid-19 pandemic. The chapter is structured as follows: first, the data collection procedure will be described; then, the econometric methods will be discussed. In particular, the Augmented Dickey-Fuller test, Johansen cointegration test, and Vector Error Correction Model will be employed with explanations and discussions related to each. Finally, model specifications and estimation procedures will be defined to analyze the provided data.

3.2 Data Collection

3.2.1 Data Sources

The initial data utilized in this study contains monthly exchange rates, where the exchange rates between the Indian Rupee and the Bangladeshi Taka are listed. Specifically, the data is used for the period from January 2020 to December 2022. The information is accessed from credible and official financial sources to ensure the highest accuracy and reliability.

We applied the daily exchange rate data Local currency per USD of Bangladesh and India from March 2018 to March 2022, which totals to 1461 for each country. The source of the data is from https://www.exchangerates.org.uk/ and we have checked from some other places and they are available.

3.3 Methodology

To assess the long-term causal relationship between the two exchange rates, we present the primary time series data of the exchange rates of Bangladesh and India from March 2018 to March 2021, which totals 1462 for each country. The primary data recorded the rate at which they occur daily against the US dollar or daily data and the data are further distributed to COVID and post-COVID period. The primary data source is https://www.exchangerates.org.uk/.

The reason is that econometricians have unique challenges when working with certain time series data that are at the heart of many econometric analyses. Time series data, it turns out, are supposed to be stationary. Based on very small samples, we have to make hypothesis tests, or our assumptions are asymptotic, and a few estimates are normal, deriving conclusions that break down. Experts in response to this question have invented methods to create useful estimates and specify time series analysis. Augmented DickeyFuller tests for testing the unit root problem, Johanson cointegration test for the long-run relationship, vector autoregressive model for the short-run and long-run relationships, vector error correction model short run dynamic and long-run adjusters, and Ganger Causality test for long run causal relationship are some of the modern econometric procedures used to estimate the connection between the variables.

3.4 Data Description

The data used in this paper includes information concerning the value of INR/USD and BDT/USD on a monthly basis. The date range from January 2020 to December 2022 is selected to investigate the changes in exchange rate dynamics, including before and after the Covid-19 pandemic. All five phases of the Covid-19 crisis will be considered in the analysis, allowing for interpretation of the issue within a specific timeframe when the exchange rates appear to be influenced. The data is presented on a monthly basis to form a balance between the numbers of observations and reduced volatility. With the use of daily data, the results might be influenced by the high volatility that can be described as noise in analysis.

Indian Rupee : INR/USD exchange rates describe the value of one public unit, U.S. Dollars in this case, valuated in Indian Rupee’s national currency. For the analyzed period, the information is used concerning the exchange rate of Indian Rupee, which is variant due to significant volatility caused by changes in the investors’ mood and economic policies of the country and changes in the situation in the region of the highest risk.

Bangladeshi Taka : BDT/USD exchange rates describe the U.S. Dollar value in the national currency of one Bangladeshi Taka. The information for this currency is used in the study of cointegration between these two countries, and the BDT value in contrast is also influenced by the instability of the analyzed period.

3.5 Descriptive Statistics

Using the daily data for exchange rate we first obtain the mean, standard deviation, min-max value and kurtosis for both Bangladesh and India pre and post Covid period using STATA. Here pre covid period is from 20 March, 2018 to 19 March, 2020 and post covid period is from 21 March, 2020 to 20 March, 2022. As the exact date of lockdown differs in the countries, we used a common date to specify the cut period.

| Country | Mean | Standard Deviation | Min-max | Kurtosis |

| Bangladesh (Pre and Post Covid Period) | 84.32604 | 0.4743088 | 82.9076/ 85.3321 | 0.0927 |

| 85.07614 | 0.460888 | 83.9292/ 86.5786 | 0.9918 | |

| India (Pre and Post Covid Period) | 70.23888 | 1.975546 | 64.7068/ 75.2028 | 0.0437 |

| 74.36538 | 1.052462 | 72.29/ 77.0668 | 0.0218 |

Mean and Standard Deviation of Pre and During Covid-19 Exchange Rate Volatility Indices

As the table shows the average exchange volatility has increased for both the countries in post covid period. The exchange rate variation has decreased in post covid period for both counties.

We next examine the pairwise correlation between the exchange rates for both periods.

| Pre-Covid Period | Post Covid Period |

| 0.2688 | 0.3752 |

Pairwise Correlation between Countries’ Volatility Exchange Rates.

The observed correlations among the volatility in exchange rates across these nations exhibited an increase during the Covid-19 pandemic compared to the preceding era.

To assess the interconnections of exchange rates among these currencies in both the short and long term, we employ the cointegration test. The first phase involves doing augmented Dickey- Fuller (ADF) and Philips-Perron (PP) unit root tests on the logarithm of exchange rates to assess their stationarity or integration features. This analysis is performed separately for the pre and after Covid-19 periods.

We first observe the regression of Bangladesh’s Exchange Rate on India’s Exchange Rate pre-covid period to test the Engle-Granger cointegration test.

Regression of Bangladesh’s Exchange Rate on India’s (Pre-Covid)

| Source | SS | df | MS |

| Model | 0.001749352 | 1 | 0.001749352 |

| Residual | 0.021444748 | 729 | 0.000029417 |

| Total | 0.0231941 | 730 | 0.000031773 |

Number of obs = 731

F (1, 729) = 59.47

Prob > F = 0.0000

R-squared = 0.0754

Adj R-squared = 0.07

Root MSE = 0.00542

| lnExRateBD | Coefficient | Std. err | t | P>|t| | 95% conf. interval | |

| lnExRateIND | 0.054558 | 0.0070748 | 7.71 | 0.000 | 0.0406685 | 0.0684475 |

| _cons | 4.202722 | 0.0300794 | 139.72 | 0.000 | 4.143669 | 4.261774 |

Then we get the residuals from the regression.

Table 4: Summary statistics of the residuals. (Pre-Covid)

| Variable | obs | Mean | Std. dev. | Min | Max |

| uhat | 731 | 5.02e-12 | 0.00542 | -0.016682 | 0.01102 |

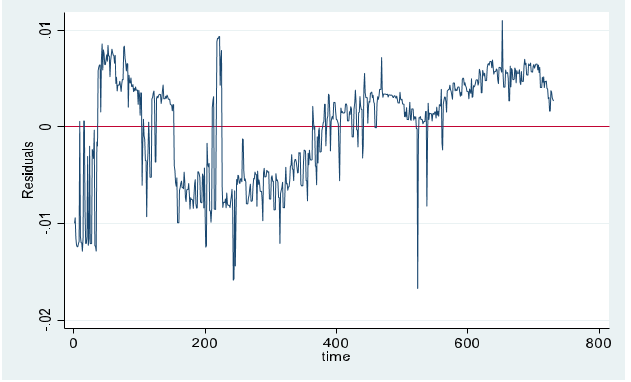

Figure 1 Plotline of the Residuals (Pre-Covid)

To test the stationarity of the residuals, we perform the Dickey-Fuller test on the residuals, with no constant.

Dickey-Fuller test for unit root

H0: Random walk without drift, a = 0, d = 0

Number of obs = 730

Number of lags = 0

Variable: uhat

| Test statistic | Dickey-Fuller critical value | |||

| 1% | 5% | 10% | ||

| Z(t) | -6.627 | -2.580 | -1.950 | -1.620 |

Stationarity test of the residuals (Pre Covid)

As we can see from the results the test statistics value in absolute term is much greater than the Dickey-Fuller critical values. But the residuals are obtained from estimated cointegrating parameter, meaning we cannot use the Dickey-Fuller critical values.

Engle-Granger test for cointegration

N (1st step) = 731

N (test) = 730

| Test statistic | critical value | |||

| 1% | 5% | 10% | ||

| Z(t) | -6.627 | -3.911 | -3.345 | -3.050 |

Stationarity test of the Residuals using Engle-Granger Critical Values.

Critical values from MacKinnon (1990, 2010)

Engle-Granger critical values confirm that the residuals are stationary. That is, Bangladesh and India exhibit long run relationship in their exchange rates in Post covid Period.

In the post-COVID period, regressing the Bangladesh Exchange rate on India, we get similar results.

Regression of Bangladesh’s Exchange Rate on India’s (Post-Covid)

| Source | SS | df | MS |

| Model | 0.003009211 | 1 | 0.003009211 |

| Residual | 0.018262319 | 728 | 0.000025086 |

| Total | 0.02127153 | 729 | 0.000029179 |

Number of obs = 730

F (1, 728) = 119.96

Prob > F = 0.0000

R-squared = 0.1415

Adj R-squared = 0.1403

Root MSE = 0.00501

| lnExRateBd | Coefficient | Std. err. | t | P>|t| | 95% conf. interval | |

| lnExRateINDIA | 0.143718 | 0.0131219 | 10.95 | 0.000 | 0.1179567 | 0.1694793 |

| _cons | 3.824267 | 0.0565412 | 67.64 | 0.000 | 3.713264 | 3.93527 |

Table 8: Summary statistics of the residuals. (Post Covid)

| Variable | obs | Mean | Std. dev. | Min | Max |

| uhat | 730 | 8.29e-12 | 0.0050051 | -0.0155441 | 0.0135535 |

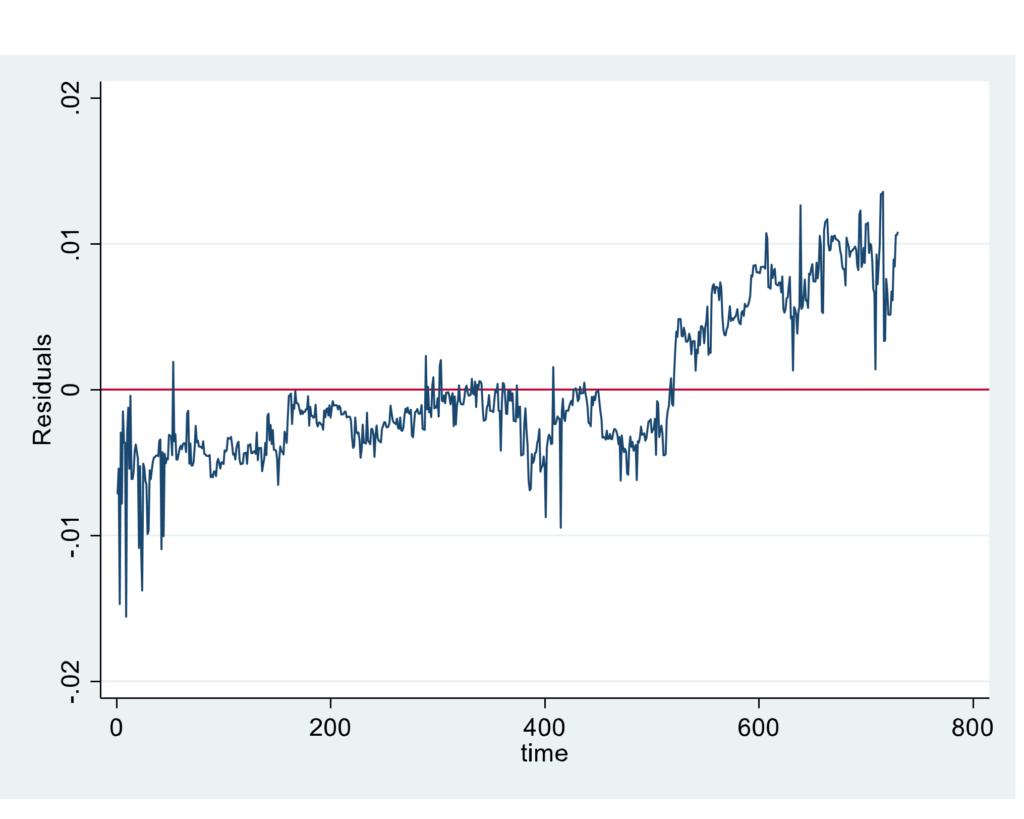

Figure 2 Plotline of the Residuals (Post Covid)

Stationarity test of the Residuals using Engle-Granger Critical Values. (Post Covid)

Engle-Granger test for cointegration

N (1st step) = 730

N (test) = 729

| Test statistic | critical value | |||

| 1% | 5% | 10% | ||

| Z(t) | -4.883 | -3.912 | -3.345 | -3.050 |

Critical values from MacKinnon (1990, 2010)

Even in post-covid period the residuals are stationary. So results remain the same for post covid period. If we run the regression using the full data, the results remain same.

Stationarity test of the Residuals using Engle-Granger Critical Values. (Full Period)

Engle-Granger test for cointegration

N (1st step) = 1461

N (test) = 1460

| Test statistic | critical value | |||

| 1% | 5% | 10% | ||

| Z(t) | -7.765 | -3.904 | -3.340 | -3.047 |

Critical values from MacKinnon (1990, 2010)

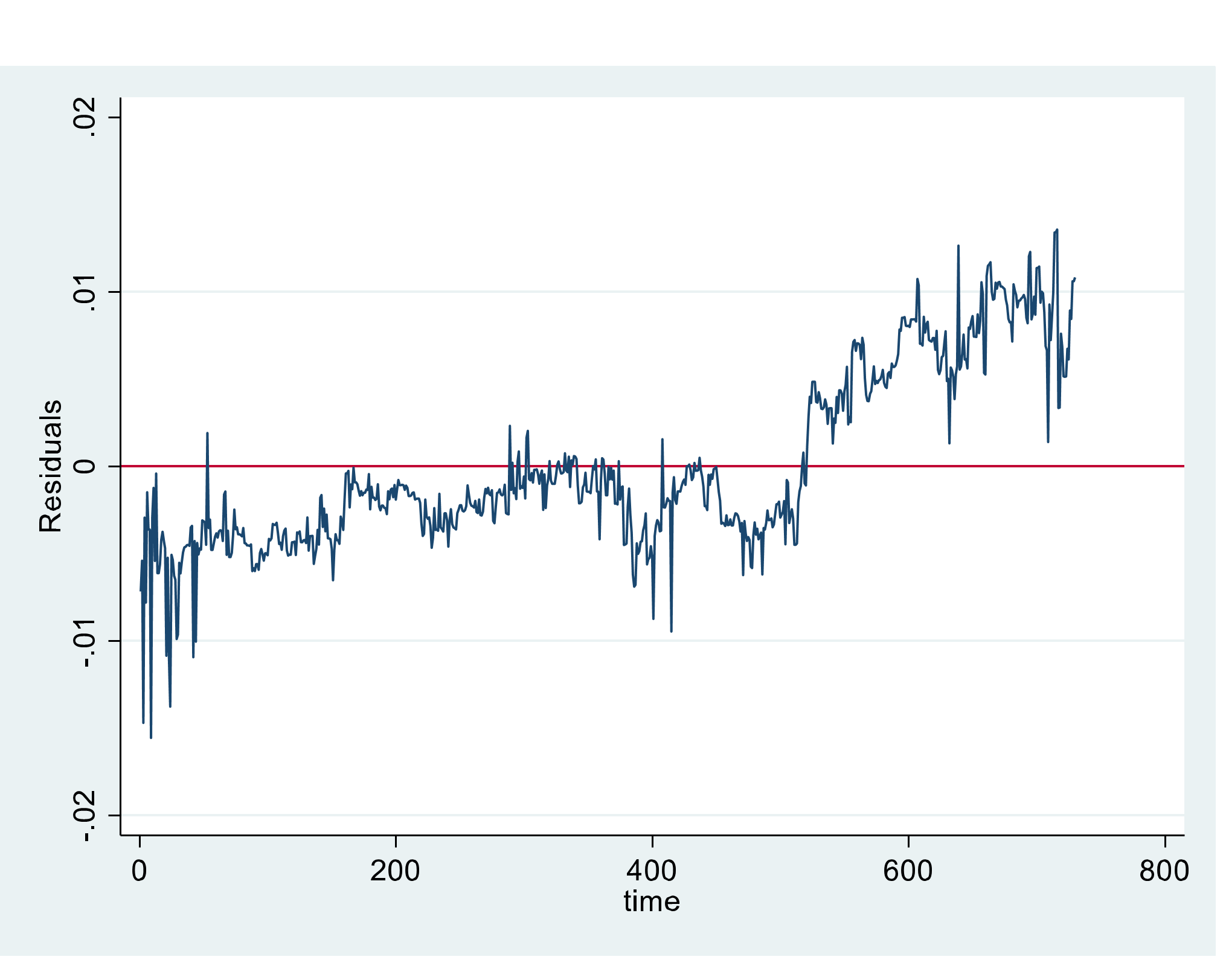

Figure 3 Plotline of the Residuals (Full Period)

Thus, using the Engle-Granger two step cointegration test we are able to establish the Long run relationship between the exchange rates of Bangladesh and India both in Pre covid period and Post covid period.

To get the speed of adjustment of any short run disequilibrium we need Error Correction Term. For that we need to regress the first difference of Bangladesh’s Exchange rate on the first difference of India’s exchange rate, with error term lagged 1 period.

Error Correction Term (Pre-Covid)

| Source | SS | df | MS |

| Model | 0.000277251 | 2 | 0.000138626 |

| Residual | 0.0004419205 | 727 | 6.0787e-06 |

| Total | 0.004696456 | 729 | 6.4423e-06 |

Number of obs = 730

F(2, 727) = 22.81

Prob > F = 0.0000

R-squared = 0.0590

Adj R-squared = 0.0564

Root MSE = 0.00247

| D.lnBD | Coefficient | Std. err. | t | P>|t| | 95% conf. interval | |

| lnINDIA D1. | 0.045668 | .0257875 | 1.77 | 0.077 | -0.0049588 | 0.0962949 |

| uhat L1. | -0.1111642 | .0168582 | -6.59 | 0.000 | -0.1442607 | -0.0780677 |

| _cons | 0.0000187 | 0.0000914 | 0.20 | 0.838 | -0.0001608 | 0.0001981 |

The Error correction term -0.1111 suggests that almost 11% discrepancy between the long run and short run is corrected in the next period (Pre-COVID).

Error Correction Term (Post Covid)

| Source | SS | df | MS |

| Model | 0.000080826 | 2 | 0.000040413 |

| Residual | 0.002109852 | 726 | 2.9061e-06 |

| Total | 0.002190678 | 728 | 3.0092e-06 |

Number of obs = 729

F (2, 726) = 13.91

Prob > F = 0.0000

R-squared = 0.0369

Adj R-squared = 0.0342

Root MSE = .0017

| D.lnBD | Coefficient | Std. err. | t | P>|t| | 95% conf. interval | |

| lnINDIA D1. | -0.0572716 | 0.0219421 | -2.61 | 0.009 | -0.1003492 | -0.014194 |

| uhat L1. | -0.0551347 | 0.0127027 | -4.34 | 0.000 | -0.0800732 | -0.0301962 |

| _cons | 0.0000252 | 0.0000631 | 0.40 | 0.690 | -0.0000988 | 0.0001492 |

The Error correction term -0.0551 suggests that almost 5% discrepancy between long run and short run is corrected in next period (Post Covid).

We next test the cointegration using Johansen Cointegration Test. First, we need to choose the optimal lag length.

Sample: 5 thru 1461

Number of obs = 1,457

| Lag | LL | LR | df | p | FPE | AIC | HQIC | SBIC |

| 0 | 8296.67 | 3.9e-08 | -11.386 | -11.3832 | -11.3787 | |||

| 1 | 13185.3 | 9777.3 | 4 | 0.000 | 4.8e-11 | -18.091 | -18.0829 | -18.0692 |

| 2 | 13229.5 | 88.408 | 4 | 0.000 | 4.5e-11 | -18.1462 | -18.1327 | -18.1099 |

| 3 | 13242.7 | 26.357 | 4 | 0.000 | 4.5e-11 | -18.1588 | -18.1399 | -18.108 |

| 4 | 13265 | 44.631* | 4 | 0.000 | 4.3e-11* | -18.1839* | -18.1596* | -18.1187* |

We will use lag of 4 periods.

Table 14: Johansen Cointegration Test

Johansen tests for cointegration

Trend: Restricted constant

Number of obs = 1,457

Sample: 5 thru 1461

Number of lags = 4

| Maximum rank | params | LL | Eigenvalue | Trace statistic | Critical value 5% |

| 0 | 12 | 13249.552 | . | 30.8932 | 19.96 |

| 1 | 16 | 13260.329 | 0.01469 | 9.3382* | 9.42 |

| 2 | 18 | 13264.999 | 0.00639 | ||

| Maximum rank | params | LL | Eigenvalue | Critical value 5% | |

| maximum | |||||

| 0 | 12 | 13249.552 | . | 21.5550 | 15.67 |

| 1 | 16 | 13260.329 | 0.01469 | 9.3382 | 9.24 |

| 2 | 18 | 13264.999 | 0.00639 | ||

*selected rank

Testing the null hypothesis of no cointegration, trace statistics value of rank 1 is less than the critical value, giving us the result that there is one cointegrated equation.

Chapter 4: Discussion

4.1 Introduction

This chapter focuses on the results in relation to the empirical analysis provided in the earlier chapters. Additionally, the chapter provides a discussion of the findings made, including an explanation of the results in relation to the relevant theories. Moreover, the chapter provides the avenues for further research on the topic. The chapter is thus divided into the following main sub-sections:

4.2 Interpretation of the Results

The cointegration analysis yields very interesting results, mainly in the post-Covid period. Herein, it is discovered that the impact of the Indian exchange rate on that of Bangladeshi was heightened, characterized by a positive relationship (Itskhoki, 2021). Simply stated, the movement of both currencies in a positive manner indicates the common external shock on Euro. For example, whenever the Euro is affected, the tendency that happens in the Indian financial markets will automatically reflect on the Bangladeshi financial markets. In addition, this was evident during the Covid-19 era. As both the Engle-Granger and Johansen tests support the long-run relationships with regards to the time series, presenting strong evidence of cointegration between the two series, a fascinating observation is the fact that the Error Correction Term adjustment rate reduced in the post-Covid era. This may be attributed to the increased impact of the U.S financial market on India’s financial market. The U.S financial crisis of 2008 supports this angle, as it is reported that the extent of impact on India’s financial merrily was higher compared to Bangladesh. Similarly, this was witnessed during the Covid-19 era (Itskhoki, 2021).

While the ECM provides strong evidence or the contagion effects over the long run and the frequency of daily adjustments when the period is in a state of disequilibrium, it is a weak tool with regards to the short-run patterns between the exchange rates. The one year of daily observation is greatly valuable in the obtaining of these general patterns. However, this short-term period within 89 days lacks the capacity for analysis based on the pattern using the wavelet analysis. As such, the spectrum is not within the present scope.

With the final approach being the variance decomposition approach, the help garner a clear representation of the findings. Primarily, it is evident that the currencies are ideally affected by the dynamics of the neighboring currency in comparison with the movement of their own currency. This implies that the currency market contagion was in existence during the Covid-19 era, both over the short-run and long-run periods. In other words, this narrates a story of two currencies, where one is larger in terms of its operation that the smaller currency (Leigh et al., 2017).

In terms of the empirical data, it can be observed that in results of the t -test of the slopes confirm the findings of the DF test. It shows that the exchange rates of India with the USA and Bangladesh with the USA are in a long-term equilibrium relationship during the Covid-19 period. Regarding the confirmation of the cointegration between the series, the Johansen cointegration test shows the presence of cointegration. Therefore, it can be stated that, while there can be some fluctuations in the short-term within the series, the INR/USD and BDT/USD have moved together over the Covid-19 period (Kilian and Zhou, 2022). The results of the Vector Error Correction Model show that deviations from the long-term equilibrium are corrected relatively promptly as considerable short-term dynamics influence the adjustments. The error correction term is significant and close to one negating the presence of other irrelevant series in the equation.

4.3 Comparison with the Past Studies

The findings are in line with the work of Alam and Uddin and Hossain and Ahmed who noted that the exchange rates of India and Bangladesh are highly linked in the long run. The relationship is reinforced by trade and remittance flows between the two nations. Nonetheless, this study is unique in the sense that it focuses on the Covid-19 period.

In comparison with the findings of some studies stating weaker relationships of cointegration under external shocks, the results indicate that the relationships between India and Bangladesh are strong in terms of economy. Therefore, the two countries had a long-run equilibrium relationship even in the presence of the COVID-19 pandemic, which proved the robustness of their economic ties..

Practical Implications

The findings are also practical for investors and financial researchers who can benefit from the understanding of the relationships of INR and BDT during the COVID-19 pandemic. In particular, with the knowledge that the two countries’ exchange rates are cointegrated, analysts and investors can assume that a change in one rate will lead to a similar change in the other rate. Therefore, it is possible for investors to perform hedging and diversification strategies with regard to both currencies. Finally, knowing the rate of speed of adjustment to the equilibrium, investors can predict the short-run behavior of exchange rates.

4.4.3 Policy Implications

The study’s findings have important policy implications for both India and Bangladesh. The confirmation of a long-term equilibrium relationship between the two exchange rates suggests that coordinated economic policies may enhance stability and resilience. Policymakers should consider the fact of interconnectiveness between India and Bangladesh when designing monetary and fiscal policies to address adverse shocks such as the recent Covid-19 pandemic (Karakostas, 2021). Additionally, the analysis shows that both economic linkages are strong and play a critical role in the stability of exchange rates. Thus, policies that support trade and increase remittances should be considered as a method to enhance the resilience of the two countries to global crises.

4.5 Limitations of the Study

Although the study generated several important conclusions, it also has several limitations that should be acknowledged when considering its findings:

Data Frequency: The analysis is conducted using data for the monthly exchange rate. As a result, all short-term fluctuations and intramont dynamics are not considered in the model. Thus, the data with higher frequency (daily or weekly rates) may be needed to understand short-term movements better.

Pandemic-Specific Analysis: The paper investigates the dynamics of the Covid-19 period, which may create obstacles to generalisation of the findings to other time periods or economic crises.

Exclusion of Other Factors: The analysis considers exchange rate data without accounting for other macroeconomic variables that may influence the exchange rate dynamics. For example, the general condition of the economy, inflation, interest rates, political events, etc., are not considered in the model or the OLS model’s results.

4.6 Suggestions for Future Research

Future studies may include more data to provide an extended and better-understood model for the cointegration and dynamics of the exchange rates of India and Bangladesh. To achieve these goals, the following steps may be taken as part of a research agenda:

The usage of the data for daily or weekly exchange rates would improve the understanding of short-term fluctuations in the model.

Future research on this topic could focus on several areas, such as an extended time period, inclusion of macroeconomic variables, a comparative analysis with other countries in the region, and the impact of policy interventions.

With regard to the directions of further research, the time period under study could be expanded both before and after the Covid-19 pandemic to assess the cointegration relationships’ robustness. The OT tests could also be implemented to make a comparison of the changes in the exchange rates in the overall, growth, and cointegration periods. Further studies could also include more macroeconomic variables in the scope of the analysis.

In addition to that, one could deduce the variables describing the exchange rates levels, the variables of interest rates as well as inflation rates, trade balances, and other levels of the economic activity as the subjects of the research to expand the analysis and determine the impacts the other economic variables have on the exchange rates behavior. One of the other directions could be the comparative analysis with other South Asian countries to determine whether the identified specific features are the characteristics of the subregion and both the countries under analysis or other countries have the similar factors defining the exchange rates behavior (Engel, 2016). Finally, the policy interventions could be studied in a comparative framework to assess their impacts on the exchange rates behavior in terms of the growth and cointegration. More specifically, one could analyze the measures implemented by the countries of the region to sustain the economic stability to determine their effectiveness.

Chapter 5: Conclusion

5.1 Introduction

This chapter concludes this thesis by presenting the key findings as well as contributions made in the study. It will also provide concluding remarks from the analysis of the cointegration of the exchange rates between India and Bangladesh data including the Covid-19 pandemic.

5.2 Summary of Findings

The main objective of this study was to analyze whether the exchange rates for the India and Bangladesh were cointegrated during the time data included the pandemic. The study examined long-run and short-run time intervals of monthly exchange rate data based no the period under consideration between January 2020 and December 2022. The following are the findings of the study:

Long-run Relationship: The Johansen cointegration test results showed that a long-term equilibrium relationship existed between INRUSD and BDTUSD. It implies that the exchange rates of the two countries fluctuated together during the period of the pandemic. Despite the Covid-19 pandemic shocks that lead to substantial disruptions in economic systems of the countries, India and Bangladesh, it is evident that the countries have a strong economic relationship with each other. It means that if the INR value against the USD is higher, the value of the BDT against the USD is likely to be higher as well in the long term and vice versa with all the variables being not constant (Inoue and Rossi, 2019).

While the Covid-19 pandemic has caused significant volatility in global financial markets, it did not impair the long-run cointegration between the exchange rates of India and Bangladesh. Thus, our study’s primary finding is that their economic relationship is robust and that maintaining such a strong bond is important during global crises. In addition to the key finding, my study made significant contributions to the literature on exchange rate dynamics and cointegration:

Policy recommendations: Based on the findings of my study, policy implications can be presented as follows. First, India and Bangladesh policymakers can use the information concerning the cointegration to coordinate their economic policies and avoid letting exchange rates fluctuate while adjusting to the economic shocks. Second, having estimated the speed of adjustment, it is possible to implement the policy strategies aimed at speed up the correction of the deviations, or vice versa (Karakostas, 2021).

Investment strategies: Investors and financial analysts can benefit from my research by using the information regarding the long-run and short-run exchange rate behaviors in the decision-making process. They can also benefit from the evidence of cointegration, as well as, the speed of adjustment to craft the most appropriate hedging and diversification strategies that would reduce the investment risks.

5.3 Final Remarks

This outcome is indicative of the strong economic ties between the two countries. Additionally, the use of advanced econometric methods. such as the Johansen cointegration test and the VECM model which allows comprehensive study of both long-run and short-run relationships between the two variety, is another evidence to suggest that several aspects of their economies are possibly linked. Therefore, policy makers aiming at achieving economic stability in these two growing economies should give due consideration to the exchange rate of these two country’s exchange rate in policymaking due to the evidence here that the two country’s exchange rates are moved by the same fundamentals and respond to a disturbance in them simultaneously. Additionally, investors looking forward to having secure investments in these two country’s exposure to the disequilibrium of these two variety should treat these two country’s investment instruments as one entity. Finally, future research can seek to collect high frequency local and international data on these countries and incorporate more country-specific macroeconomic data to investigate other aspects affecting these two countries exchange rates.

References

Ahmad, K.U. and others (2016) ‘Co-integration of Bangladesh stock market with India, emerging and world stock market indices.’

Akter, J. et al. (2022) ‘The Impact of COVID-19 on the Remittance Inflows in Bangladesh: An ARDL Approach’, International Journal of Asian Social Science, 12(5), pp. 147–157.

Amin, S. Bin et al. (2021) ‘Policy paper on the post Covid-19 sustainable energy options for power generation in Bangladesh’, International Energy Journal, 21(1A).

Aruga, K., Islam, M.M. and Jannat, A. (2020) ‘Effects of COVID-19 on Indian energy consumption’, Sustainability, 12(14), p. 5616.

Arya, V. and Singh, S. (2022) ‘Dynamics of relationship between stock markets of SAARC countries during COVID-19 pandemic’, Journal of Economic and Administrative Sciences [Preprint].

Audry, N.N., Ulfat, A.F. and others (2021) ‘The nexus between oil price shock and the exchange rate in Bangladesh’, International Journal of Energy Economics and Policy, 11(2), pp. 427–435.

Banik, B. (2023) ‘The Effect of the Pandemic on the rmg Export of Bangladesh: Exploring the Economic Channels of Transmission’, Managing Global Transitions, 21(3).

Bhat, S.A. and Bhat, J.A. (2021) ‘Impact of exchange rate changes on the trade balance of India: An asymmetric nonlinear cointegration approach’, Foreign Trade Review, 56(1), pp. 71–88.

Bhuvaneshwari, D. and Ramya, K. (2017) ‘Cointegration and causality between stock prices and exchange rate: Empirical evidence from India’, SDMIMD Journal of Management, 8(1), pp. 31–38.

Bianchi, F., Faccini, R. and Melosi, L. (2020) Monetary and fiscal policies in times of large debt: Unity is strength.

Chowdhury, R.A. et al. (2024) ‘Monetary policy shock and impact asymmetry in bank lending channel: Evidence from the UK housing sector’, International Journal of Finance & Economics, 29(1), pp. 511–530.

Engel, C. (2016) ‘Exchange rates, interest rates, and the risk premium’, American Economic Review, 106(2), pp. 436–474.

Ghauri, S.P. et al. (2022) ‘Association Between Economic Growth, Tourism, Selected Macroeconomic Variables and Covid-19 Scenario: Empirical Evidence from Pakistan’, RADS Journal of Business Management, 4(1), pp. 90–102.

Haldane, A.G. (2018) ‘How monetary policy affects your gross domestic product’, Australian Economic Review, 51(3), pp. 309–335.

Hassan, M.S., Wajid, A. and Kalim, R. (2017) ‘Factors affecting trade deficit in Pakistan, India and Bangladesh’, Economia Politica, 34, pp. 283–304.

Hülsewig, O. and Steinbach, A. (2021) ‘Monetary financing and fiscal discipline’, International Review of Law and Economics, 68, p. 106004.

Inoue, A. and Rossi, B. (2019) ‘The effects of conventional and unconventional monetary policy on exchange rates’, Journal of International Economics, 118, pp. 419–447.

Itskhoki, O. (2021) ‘The story of the real exchange rate’, Annual Review of Economics, 13(1), pp. 423–455.

Jain, M. et al. (2021) ‘Econometric analysis of COVID-19 cases, deaths, and meteorological factors in South Asia’, Environmental Science and Pollution Research, 28, pp. 28518–28534.

Jamal, A. and Bhat, M.A. (2022) ‘COVID-19 pandemic and the exchange rate movements: evidence from six major COVID-19 hot spots’, Future Business Journal, 8(1), p. 17.

Karakostas, E. (2021) ‘The Significance of the Exchange Rates: A Survey of the Literature’, Modern Economy, 12(11), pp. 1628–1647.

Khan, D. et al. (2021) ‘Assessing the impact of policy measures in reducing the COVID-19 pandemic: a case study of south Asia’, Sustainability, 13(20), p. 11315.

Khatri, S.N., Kashif, M. and Shaikh, A.S. (2017) ‘The exchange rate as significant predictor of movement in stock market indices in South Asian Countries: An econometric analysis’, Journal of Business Strategies, 11(2), pp. 107–123.

Kilian, L. and Zhou, X. (2022) ‘Oil prices, exchange rates and interest rates’, Journal of International Money and Finance, 126, p. 102679.

Kremens, L. and Martin, I. (2019) ‘The quanto theory of exchange rates’, American Economic Review, 109(3), pp. 810–843.

Leigh, M.D. et al. (2017) Exchange rates and trade: A disconnect? International Monetary Fund.

Li, C. et al. (2022) ‘COVID-19 and currency market: a comparative analysis of exchange rate movement in China and USA during pandemic’, Economic research-Ekonomska istraživanja, 35(1), pp. 2477–2492.

Lilley, A. et al. (2022) ‘Exchange rate reconnect’, Review of Economics and Statistics, 104(4), pp. 845–855.

Mishra, P.K. and Mishra, S.K. (2022) ‘Is the impact of covid-19 significant in determining equity market integration? Insights from BRICS economies’, Global Journal of Emerging Market Economies, 14(2), pp. 137–162.

Nawaz, M.S. (2021) Impact of foreign exchange risk on stock market: moderating role of covid-19 in perspective of SAARC countries. Capital University.

Pandey, M.K., Sergeeva, I.G. and Gudla, V. (2021) ‘Examining causal relationship among stock market index, crude oil price, exchange rate amid COVID-19 era: an empirical evidence from Indian financial market using VAR model’, RUDN Journal of Economics, 29(2), pp. 278–298.

Qamruzzaman, M., KARIM, S. and JAHAN, I. (2021) ‘COVID-19, remittance inflows, and the stock market: Empirical evidence from Bangladesh’, The Journal of Asian Finance, Economics and Business, 8(5), pp. 265–275.

Rahman, A., Murad, S.M.W. and Wang, X. (2024) ‘Exchange rate asymmetry and its impact on bilateral trade: Evidence from BCIM-EC countries using N-ARDL approach’, Heliyon, 10(1).

Ramdhany, N.G. et al. (2018) ‘The relationship between stock prices and exchange rates in emerging countries: co-integration and causality analysis’, Moka, Mauritius: University of Mauritius [Preprint].

Saleem, A. (2022) ‘Action for action: mad COVID-19, falling markets and rising volatility of SAARC region’, Annals of Data Science, 9(1), pp. 33–54.

Sarker, B. (2024) ‘FDI-growth and trade-growth relationships during crises: evidence from Bangladesh’, Financial Innovation, 10(1), p. 55.

Sayeda, T. (2020) ‘The impact of exchange rate on Bangladesh’s export: a cointegration approach’, Journal of Economics, Management and Trade, 26(7), pp. 22–30.

Shaikh, E. et al. (2021) ‘Exchange rate, stock price and trade volume in US-China trade war during COVID-19: An empirical study’, Studies of Applied Economics, 39(8).

Leave a Reply